California Overtime Laws – What Every Business Should Know

Updated April 6, 2024

As an employer with loyal employees, you may think an hour or two (of unpaid overtime) here and there is no big deal. It is a big deal. Pay any overtime due, every time. Here’s why.

Can You Be Fined for Not Paying Overtime in California?

Very much so.

As a payroll specialist for small and medium-sized businesses for decades, I can help you understand the California OT (overtime) rules and make sure you’re never penalized for breaking them.

What happens if you don’t pay overtime?

We know of employers who didn’t pay overtime – they thought the law was that overtime only came into play when hours worked exceeded 40 in a week (not the case in California) – or the employee said “don’t worry about it” thinking they could “bank” the hours to use another time.

While you may have the best employee now, as soon as employment ends, the “best” employee can turn into the worst former employee. The end result of not handling overtime correctly can be thousands of dollars in fines for a single employee.

Missed meal breaks and not paying final wages (whether they quit or are fired) also come with similar hefty fines (more on this topic in a separate blog post).

This will only get worse for the employer and be nearly impossible for them to dispute (unless they did, in fact, pay overtime, give breaks, or pay final wages as they should have). The employer has the burden of proof to provide detailed documentation and facts.

Employers are responsible for paying overtime when employees work overtime—it’s as simple as that. Fines can be thousands of dollars for something that could have cost a fraction of those hefty fines, so it’s easier to do the right thing the first time.

Overtime Rules Depend on Employee Classification

Employees who are eligible for overtime are called NON-EXEMPT employees.

Those who are not eligible for overtime are called EXEMPT employees. If the employees are exempt, these overtime laws don’t apply to them because they have a specific classification or a special rule designation.

Examples of these exempt or special rule designations include executives or administrators paid on a salary basis, independent contractors, volunteers, and outside salespeople.

More Interesting Overtime Pay Exemptions:

- Sheepherders

- Relatives of employer

- Drivers who work in the transportation industry

- Taxicab drivers

- Carnival ride operators for traveling carnivals

- Professional actors

- Crew members on a commercial fishing boat

- Personal attendants

- Minors who are employed as babysitters

Curious if your employee qualifies for an exemption? Ask your HR Department or call us (whether you’re a client or not) and we’ll research for you.

Who Decides What Counts as Overtime?

All of this is governed federally by the Fair Labor Standards Act (FLSA). For California, overtime rules are governed by the Division of Labor Standards Enforcement (DLSA). Under federal and state laws, employees are entitled to overtime wage rates when any overtime work is performed. Employers are to follow the law that favors the employee more.

If you’re outside of California, our payroll service handles every state, so please message us on our Pacific Payroll Group contact page. We’re happy to help business owners at any level.

California Overtime (OT) Laws

The wage rate for overtime depends on when the overtime work takes place.

Employees are entitled to 1.5 times their regular wage rate if they work more than 40 hours during a workweek. Same goes for any non-exempt employee who works more than 8 hours during a single workday or any hours worked on a 7th consecutive day in the workweek.

And if they work more than 12 hours during a workday (or more than 8 hours during a 7th workday), they are entitled to twice their regular rate of pay.

- Daily threshold for overtime is at 8 hours worked and double time at 12 hours worked

- On 7th consecutive day worked of workweek, all hours are set to overtime and double time at 8 hours

- Sets weekly overtime at 40 hours

- Overtime is calculated based on hours actually worked. Sick, vacation, PTO, holiday pay hours are not counted as hours actually worked

- Workweek need not follow nor be the same as a calendar week. Both instances however are a fixed set of seven consecutive days

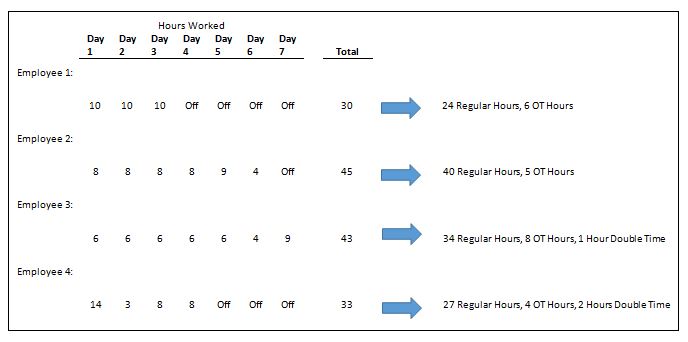

California Overtime Examples

Steps:

- Any Hours in a day over 8 but less than 12? If so, move them to overtime

- Any Hours in a day over 12? If so, move them to double-time

- Any Hours present on day 7? If so, move them to overtime and/or double-time

- Are there any remaining hours over 40 not yet promoted to overtime or double time? If so, move them to overtime

Contact us with any questions on the above guidelines. If you have questions on California overtime laws for domestic workers or caregivers, please visit our related site page.

Alternative Workweeks

If your employees have alternative workweek schedules, in California, the overtime wage requirements apply differently. In these situations, an employee can work more than 8 hours without being entitled to overtime.

Employers must pay overtime for these (alternate workweek) employees when they work over 10 hours during a workday or 40 hours during a workweek.

A workweek (in California) is a fixed period of:

- 168 hours, or

- Seven consecutive 24-hour workdays

The workweek can begin on any day and at any hour – it is designated by the employer and should remain consistent. The employer must count any time the employee is under their direction or control as hours worked.

Here are 5 tips to prevent surprises when it comes to overtime penalties:

- Track hours using a timekeeping system. Any robust system should have the capability to calculate time based on the State where the employee works.

- Ask your payroll service provider for help!

- Perform regular wage audits to ensure employees are not “padding” their time cards or falsifying the data in any way. Some employees may clock out yet still work for fear of being “talked to” for working overtime.

- Have Company or Employee meetings to ensure all parties (managers included) know the law and what the employer expects.

- Human Resources. When in doubt ask an HR professional for guidance with a problem employee.

Protecting Employers from Overtime Violations

It’s not worth missing any employee hours – the fines are too steep. It’s not worth letting a missed meal break slide. And it’s not worth missing any final wages due when they leave the company.

Make sure you have a time tracking system in place, you document everything, audit everyone’s hours at regular intervals, and communicate your employee expectations thoroughly.

Work can get hectic for everyone, but these small changes now, will protect you from huge headaches later.

Stay proactive and keep growing your business.

Calculating Regular and Overtime Pay – An Update

California Employment Law Report has a new post about calculating the regular rate of pay in order to calculate the overtime pay. Of course, if you’re using us for your payroll, we do all that for you. But if you’re curious about how it works, we encourage you to check out this article on how to Calculate Regular Rate of Pay for employees under California law.

We encourage our clients to review this Sept. 2022 article by the National Law Review called, “Time Is Money: A Quick Wage-Hour Tip on … Avoiding Common California Wage and Hour Mistakes and ‘Going the Distance’.”

Please always reach out to us (or your HR department) with questions to make sure you’re updated on the latest overtime laws and recommendations.

About the Author

Gordon Mulder, Owner and Director of Operations

Gordon began his career as a payroll and personnel manager with a Fortune 500 company in the 1990s processing payroll, time cards and reviewing employee documents to ensure compliance at the State and Federal level.

Upon leaving the corporate world, he earned his Bachelor’s degree (Business Administration – Entrepreneurship) from Wayne State University in Detroit.

Prior to starting Pacific Payroll Group in 2008, Gordon had worked in management for other payroll service bureaus focusing on client relations, internal employee training and payroll tax inquiries.

Gordon truly enjoys working with his clients, some of whom have followed him from company to company over the years.