Payroll Cards

Payroll cards (available in every state) offer a simple way to pay workers electronically (whether or not they have their own bank accounts) by using a prepaid payroll debit card. It’s easy and it will save you time.

Payroll Direct Deposit Cards

Through our paycard partner NatPay® we offer Payroll Cards for unbanked employees at NO COST to your business. These FDIC-insured debit card accounts allow employees to benefit from direct deposit. Did you know the average unbanked employee spends $182 annually just to access their pay and pay their bills?

Free your employees from the expensive shackles of a paper check with our paycard solutions. Accommodate an ever-changing workforce.

What Is A Payroll Card?

Payroll cards for employees let you pay your workers using a prepaid debit card – especially useful if employees don’t have a bank account.

Pay cards for payroll provide an easy way for employers to lower expenses (compared to using paychecks) and for employees to get paid quickly without the hassle of cashing a check.

Paycards are also called electronic payment cards, cash cards, prepaid direct deposit cards or bank debit cards.

Direct Deposit vs. Payroll Cards (Paycards)

The advantages of direct deposits include benefits for both employers and employees. These are electronic transfer payments made directly to an employee’s savings or checking account for net wages earned. This can be especially helpful with employees working remotely due to the pandemic.

It can be handled automatically, the funds are available as soon as next business day, and there’s no paper check necessary (which saves time for the employee). However, direct deposit isn’t available if a business owner is paying an individual without a bank account. In these cases, a payroll card is the next best option.

These prepaid, reloadable paycards work the same as a debit card. The debit card contains the exact amount that would have been direct deposited.

Some payroll card providers will charge fees for balance inquiries and cash withdrawals, but there are ways to avoid fees depending on your provider (see Employee Benefits below). Both options are paperless.

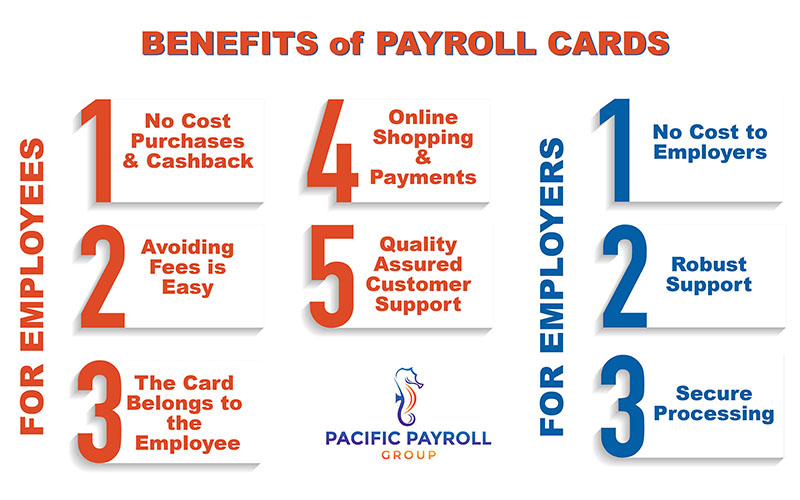

Employer Benefits Of Payroll Cards

Robust Support: Dedicated Program and Client Service managers walk clients through the implementation process, send steady supplies of marketing collateral, instantly issue cards and provide training and ongoing support.

Save Money and Time: There is no cost to employers to implement or maintain paycards. Most save $3.15 per paper check conversion, and switching to direct deposit payroll cards eliminates priceless time spent on the administrative work of paper check printing, processing, tracking and delivery.

Secure Processing: National Payment Corporation (NatPay) was founded in 1991, and became the leading company to offer third-party processing of Direct Deposit for employee payroll. The company processes more than $115+ billion annually for 228,000+ ACH clients nationwide. Paycards are secure and help mitigate the risk of delayed or lost paper checks.

Employee Benefits Of Payroll Cards

Payroll Cards for employees allow them to have their wages direct deposited to their card every payday! The card belongs to the employee, not the employer, even if they leave their job.

No Cost Purchases & Cashback: There is no charge for swiping the payroll card as credit or debit at point-of-sale transactions, and there is no cost for cashback at most grocery stores and other retailers when cardholders swipe their card as debit. Cardholders can also make one no cost Bank Teller Withdrawal of any amount once per pay period. Free in-network ATM access, unlimited bank teller withdrawals, and card-to-bank transfers.

Avoiding Fees is Easy: Employees have unlimited FREE access to over 55,000 Allpoint ATMs nationally. When making purchases, run the purchase as a CREDIT at retailer’s point-of-sale.

It’s The Employee’s Card: Each cardholder can use the card’s routing and account number to add additional direct deposits, like tax returns or a second job.

Online Shopping and Payments: Employee debit cards can be used for online shopping, renting a car, and booking a flight or hotel online.

Quality Assured Customer Support: Free 24/7/365 US-based phone support! Live bilingual customer support in English and Spanish monitored by a dedicated QA team ensures helpful, educational and consistent service. To ensure education on fees and best uses of the direct deposit debit card, cardholders receive a welcome call upon activation.