Wage Conversion Calculator

Please contact us if you have any payroll time conversion questions on calculating your hourly rate, gross pay, pay frequency, tax filing status, paystubs, allowances and withholding information, or voluntary deductions.

This easy to use Wage Conversion Calculator helps you quickly convert wages for different time periods (hourly, daily, weekly, quarterly, annually and more).

It can convert an hourly wage into the following common pay periods: daily, weekly, bi-weekly, semi-monthly, monthly, quarterly, and annually. Or you can enter a weekly, monthly or annual wage and see what your effective hourly wage rate is!

It’s simple to use:

- Enter the wages you want to convert into the payroll conversion calculator

- Choose the relevant pay period

- Select the number of hours and days in your workweek

- And hit “Calculate”

You will now see the Results appear below the paycheck calculator, listing all the $ wage amounts for each of the common pay periods. If you want to try another conversion just hit the Reset button.

|

Wage Conversion Calculator |

||

|

| ||

|

|

||

| Period | Result | |

|---|---|---|

| Annually | ||

| Quarterly | ||

| Monthly | ||

| Semi-Monthly | ||

| Bi-Weekly | ||

| Weekly | ||

| Daily | ||

| Hourly | ||

Payroll mistakes can be costly.

Imagine your productivity without handling employee questions, paid time off tracking, and payroll reports.

Call us today for a quick payroll quote – and open up free time you never thought possible.

Competitive pricing. Any state. Exceptional customer service with caring humans.

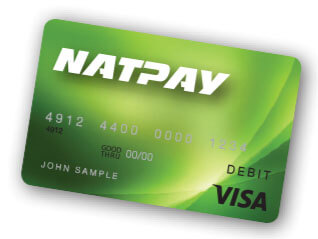

Need paycards for your employees without a bank account?

Check out our no cost payroll cards.

A simple way to pay workers electronically by using a prepaid payroll debit card.

Save on paper check conversion and switch to direct deposit!

Disclaimer: Pacific Payroll Group is providing this Salary Paycheck Calculator for estimates and it should not be intended to provide tax or legal advice and does not represent any Pacific Payroll Group service. Please refer to your payroll provider or CPA with specific concerns.